navigate

recent

Also by Gary

Commentary

AdbusterAljazeerah Info

AlterNet

Boston Review

Common Dreams

Counterpunch

Economic Roundtable

The Nation

Open Democracy

Adelaide Review

Australian Opinion

Borderlands

Brisbane Institute

Chifley Research Centre

Crikey.com.au

Dialogue

Drawing Board

The Evatt Foundation

New Matilda

Online Opinion

Oz APEC Study Centre

Tasmanian Times

Henry Thornton

Media

ABC OnlineThe Age

The Australian

The Bulletin

Media Watch

Sydney Morning Herald

Xenox News

Asia Times

BBC

China Daily

Cursor

Daily Star

Daily Telegraph

Dar Al Hayat

Google News

Guardian Unlimited

Haaretz

Independnet Media TV

Los Angeles Times

New York Times

International Herald Tribune

Washington Post

Think Tanks

Australian Conservation FoundationAustralia Institute

Australian Policy Online

Centre for Independent Studies

Doctors Reform Society

Institute of Public Affairs

Murray-Darling Basin Commission

OzProspect

Productivity Commission

World Wide Fund for Nature

Demos

Canadian Democratic Movement

International Crisis Group

Pew Centre

International Blogs

Abu AardvarkAirstrip One

Alas, a blog

Antiwar.com

Atrios

Baghdad Burning

Chez Nadezhda

Crooked Timber

Juan Cole

Conceptual Guerilla

Brad DeLong

Daily Kos

EastWestNorthSouth

Electrolight

A Fistful of Euros

Jews sans frontieres

Oxblog

Political Animal

Rafah Pundits

Rodger A. Payne

Rittenhouse Review

Stand Down

Talking Points Memo

War & Piece

Warblogger.com

Whiskey Bar

Mathew Yglesias

Oz Blogs

The DomainAlert & Alarmed

Ambit Gambit

Bargarz

Tim Blair

William Burrows' Baboon

Catallaxy

The Daily Slander

Daily Flute

Peter Gallagher

Institutional Economics

Kick and Scream

Margo Kingston's Webdiary

Meg Lees

Palmer's Oz Politics

John Quiggin

Rank & Vile

Road to Surfdom

Rob Schaap

Ruminations

She Sells Sanctuary

Southerly Buster

Troppo Armadillo

wsacaucus.org

Media Blogs

First DraftJD's New Media Musings

journoz

Lying Media Bastards

Media Savvy

Media Transparency

Media Whores Online

PressThink

RConversation

Rhetorica

vigilant.tv

Political Institutions

Australian DemocratsAustralian Greens

Australian Labor Party

Liberal Party of Australia

National Party of Australia

No-Pokies MP Nick Xenophon

Parliament of Australia

Parliament of South Australia

Cartoons

LeahyLeunig

Alan Moir

David Rowe

Steve Bell

Editorial Cartoons

London Times

Political Cartoons

Jabra Stavro

Cagle's Cartoon Weblog

South Australian Weblogs

Adelaide BlogsAdelaide Pundit

Dock of the Bay

DogfightAtBankstown

Jocknessmonster

Kerison

Tripe Soup

Ubersporting pundit

The Usurer

View from the USSR

Watchdog of the Wankers

South Australian Links

ABC AdelaideConservation Council

Energy SA

Essential Services Commission

Dept. of Environment & Heritage

Dept. Land, Water, etc

SA Central

other

« aussie blogs »

all content is copyright by the respective authors.

January 09, 2005

being ground down

Whilst John Howard has been playing the statesman in his exercise of knowledge and political power in Indonesia the ALP has been living in the shadows contemplating the eightfold path to economic enlightenment. Such contrasts in the art of politics based on sound judgement.

Moir

Little seems to be going the ALP's way.

The good news is that the ALP still controls all of the states. Will that change with WA and NSW?

WA will probably be the first to fall.

January 08, 2005

Tsunami Relief: UN v US

There has been a bit of politics being played out between the UN and the US around the emergency relief for the countries devastated by the tsunami. President Bush initially said that the US was in charge:

"We've established a regional core group with India, Japan and Australia to help coordinate relief efforts."

As Simon Tisdall writing in The Guardian observes Bush made no mention of the central coordinating role of the United Nations, nor did he offer direct assistance to the several UN agencies that were already tackling the disaster. The impression given was the ambivalence of the US to the UN's leadership role. The US did a big emergency number with money ships, marines and helicopters.

After the Jakarta summit the "core group" was disbanded and the UN's overall control of reconstruction was acknowledged. The UN sees this as an opportunity to regain some credibility.

At issue are long-standing, fundamental tensions between the world's only superpower and the pre-eminent global political organisation. Tisdall says:

"The Bush administration craves the legitimacy that only the UN can confer on its policies in places such as Iraq. On the other hand, it resents attempts by other countries, acting through the UN, to place restraints on its exercise of power.

Since the cold war ended, the UN has become the principal battleground where states' practical and ideological differences over the application of international law, multilateralist versus unilateralist solutions, and the "Bush doctrine" of pre-emptive force are fought out."

The conflict is more than that.It is also about the kind of development of the Southeast Asian region.The UN is going to use the reconstruction to go beyond delivery aid to push for its Millennium Development Goals: reducing poverty, hunger disease, illiteracy, environmental degradation and discrimination against women.

The US and Australia are not that happy about this socially driven agenda since this kind of reconstruction delinks aid from western business interests, American influence in the region and Washington's demands for US-style democracy and a market economy.

Australia has already opted out of the UN with its bilateral arrangment with Indonesia. No doubt the US will seek to head off a revitalised UN. The UN will be allowed some indepedence but only up to a point.

January 07, 2005

Relief for tsunami-ravaged nations

From the air Aceh looks to be worse than a war zone, so comprehensive is the scale of destruction. Greg Barton observes, if it were not for the overwhelming response of the international community, then the suffering of the Acehnese would have been many times worse than it is.

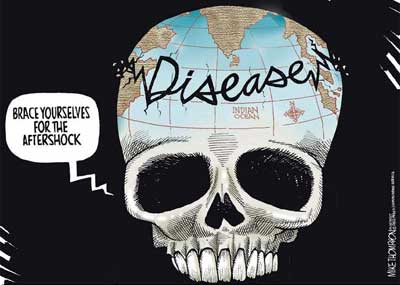

Mike Thompson, The worst is yet to come

The situation in Muslim Aceh in the absence of the international relief effort would be unspeakably bad.

In a previous post I raised the issue of the absence of the Arab states in the Middle East in the international community. The response from Muslims of Asia, where most of the world's Muslims live, and the Muslim diaspora of Europe, the US and Australia, has been to give generously and to send volunteers to pull bodies from the wreckage and to feed and treat the survivors. This is very different from the minimal response by the conspicuously silent Arab world in the Middle East.

Barton addresses this paralysis of generosity on the part of certain Arab states. He says:

"The traditionalist Muslims of Aceh, with their mystical, Sufistic approach to life and faith, are a world away from the fundamentalist Islamists of Saudi Arabia and some other Arab states. The Acehnese have never been particularly open to the bigoted "reformism" of radical Islamist groups linked to Saudi Arabia.....Perhaps it is for this reason that aid for Aceh has been so slow coming from wealthy Arab nations such as Saudi Arabia."

However, Juan Cole puts the lack of generosity into context with the generosity of the US. Maybe, but Saudi Arabia, which receives around $100 billion a year from its oil wealth, only gave $30 million. According to Abu Aardvark some Arab commentators are raising the issue of the failure of Arab states and publics to offer substantive assistance.

Greg Barton does say that these differences between Muslims over the generosity of tsunami aid undermines the conservative discourse that juxtaposes Islam and Western civilisation in a simplistic dichotomy.

January 06, 2005

livelihoods gone

It is clear that Short-term relief is not going to be enough when livelihoods and fishermen's hamlets have gone:

So what next? Maybe we need a bit of debt relief?

An argument can be found here. A counter argument. Others say that trade is more important. However, both aid and trade are needed. Europe, for instance, could acknowledge that far-reaching debt relief and the opening of its markets, would start countries such as Sri Lanka on the slow ascent out of chronic poverty. The G7 should grant debt relief.

It is also clear that the region needs more than debt relief. It needs long-term development assistance to help restore livelihoods and enable shattered communities to get back on their economic feet:

So the Australian Government's $1billion reconstruction and development package to Indonesia is to be welcomed.It will be administered by Indonesia and Australia, not the UN; and it places an emphasis on the reconstruction of the devastated region of Aceh and its future development. More detail on the package can be found at Geoffry MG's Beyond Wallacia.

I presume the focus of this package is on restoring livelihoods. Can we so presume, given the ongoing military operations still being conducted by the Indonesian military in Aceh?

However, we should retain a critical eye. Will the emergency relief, when channelled into this conflict zones, serve to feed armed conflict and undermine the ability of local economies to recover and develop?

What is clear is that Indonesia should lift its military state-of-emergency in the tsunami-devastated Aceh province and allow aid groups should not be pressured, and even forced, to turn over aid to the military for delivery.

It is clear is that there is national self-interest as well as the good neighbour humanitarianism at work in Australia's long-term development assistance to Indonesia. The development package gives Australia lots of benefits.

It enables greater cooperation with Jakarta in the war against terrorism; it helps to ensure that a viable Indonesian economy provides benefits for Australian trade and investment;it provides opportunities for Australian companies to be involved in rebuilding key insfrastructure in a devastated Aceh province; and it ensures that Australia becomes a key regional player playing a different role to the deputy sheriff of the US willing to launch pre-emptive strikes against Australia's neighbours.

Australia is doing good deeds in Indonesia. Read the Diplomad for an embassy perspective on the good on the ground work being done by the Australians and Americans, in contrast to the slow moving UN.

January 05, 2005

band aids & vaccines

A bystander looks on as bodies recovered from under debris are cremated near the sea at Nagapattinam, India, one of the many places hit by the tsunami.

AP, Gurinder Osa

Whilst The Hindu offers some good advice to the Indian government America is boosting its image amongst Muslims in the south east Asia region. The US is anxious to present a generous and compassionate face.

Danziger is right. It is a bit of a show.

The Amercians are still touchy about the European stingy criticism. The Bush administration does have a track record of promising a lot in front of the cameras then not delivering when the cameras have move on.

We are still hearing a lot about the emergency aid (band-Aid) and little about development aid (the vaccine.

Where are the contributions from rich Arab gulf states? Why don't they help to ease the debt burden of the countries stricken by the tsunami? Whey are they not advocating a debt moratorium in the first instance to ease the burdens of the past, then a Marshall Plan for the future. Their silence about Aceh is puzzling.

A Marshall Plan. That is something you'd think rich Arab nations in the Middle East would run with as it is about the development of Islamic countries.

So why their silence? It is very noticeable.

Update

Someone else has noticed:

Tsunami #8 in memoriam

Alan Moir is the best cartoonist in Australia egaging with the tsunami disaster:

Moir

An earlier Moir here.

January 04, 2005

todays quote

From Paul Sheehan writing in the Sydney Morning Herald yesterday:

"It was an auspicious week to be reminded that Australia has never had so much material wealth yet so much environmental poverty.

For more than a hundred years, a slow-motion natural disaster has been unfolding in this country - you could call it a dry tsunami - mostly invisible, but deadening over the long term, as uncountable millions of tonnes of topsoil have blown away, never to be replaced, as a result of profound ignorance of the landscape. Hundreds of thousands of Australians have left the land, unable to make a living in an environment of wasting soils, dying rivers, changing climate, eroding coasts, disappearing species, plunging biodiversity, salinisation, desertification and factory farming."

The dry tsunami image is unfortunate. But he is right about Australia being in a long-term environmental decline that has not been arrested.

January 03, 2005

Tsunami#5 lending a hand

Whilst Banda Aceh and Meulaboh in Sumatra, Indonesia will probably be reconstructed, the survivors of the destroyed towns inbetween will be evacuated.

Will the towns be rebuilt? No one is sure.

What we do know is that massive emergency aid is the content to Cox & Forkum's excellent 'lending a hand' editorial cartoon about the Indian Ocean tsunami:

It is the international community--not just south Asia---that is lending a hand to the devastated region Australia is a part of. The tsunami narrative includes the way the US was shamed by the UN into increasing its financial support from $35m to $350 million.

As an aside, a post on Cox and Forkum's weblog consists of a cartoon and some writing about the cartoon's subject matter.This is a similar way of working to what is sometimes done here at public opinion.

Editorial cartoning is a difficult profession these days. The job of an editorial cartoonist is to reveal the awkward truth when everybody else would prefer a tactful silence. Alas local editorial cartooning is dying, and the newspaper publishers are killing it. So says Malt Priggee.

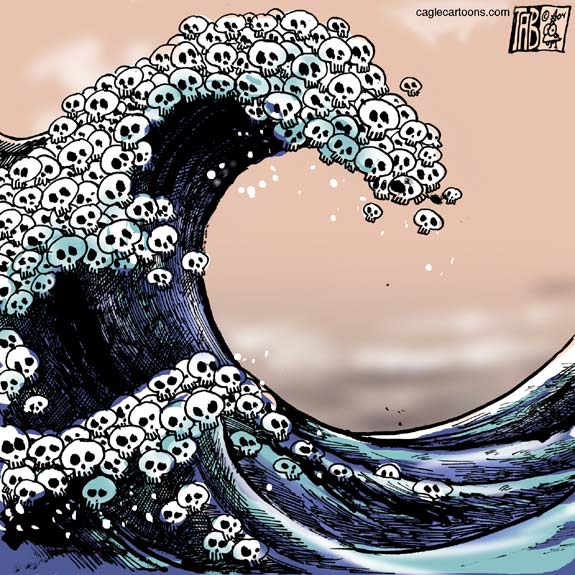

This is a pity because an editorial cartoon can say that things a photo cannot:

Tab (Thomas Boldt), The Calgary Sun, Alberta, Canada

What does lending a hand mean in the longer term? It means helping to rebuild affected nations. So how does international community lend a reconstructive hand beyond the immediate $2 billion in emergency relief?

Here is a suggestion from the Los Angeles Times. A multibillion-dollar Marshall Plan for South Asia. The Los Angeles Times says:

"The U.S. spends a bit over one-tenth of 1% of its national income on aid, less than any other developed nation. A massive American-led Marshall Plan for South Asia would cost only a fraction of the nearly $225 billion requested so far to pay for the Iraq war.And, without a doubt, it would be a far wiser investment in the war on terror."

Sounds good to me.

I would add two things.The UN should not be sidelined on this kind of generational rebuilding. Secondly, Australia should substantially increase its direct aid to Aceh and play a leading role in re-building water supplies, roads, telecommunications, schools and hospitals. Both could help prevent the Indonesian military from playing politics with aid.

January 02, 2005

Tsunami#5:good news

Indonesian news reports say that cholera-like symptoms have already begun to show up among homeless people gathered in camps near the devastated provincial capital of Banda Aceh in north western Sumatra.

Along the west coast of hard-hit Aceh province many survivors, cut off from the outside world, are threatened by starvation and sickness.

The town of Meulobah on the coast of the Aceh province in western Sumatra before the Tsunami hit.

By all accounts Meulobah is gone. An ariel image of Meulobah.

The good news is that US. Navy helicopters from the USS Abraham Lincoln aircraft carrier began arriving in Banda Aceh on Saturday. They are also beginning to run much needed missions along the west coast of the Aceh province.

It may be to late to deal with some of the infected wounds.

January 01, 2005

Tsunami#4 Aceh

Aceh has borne the brunt of the devastation from the undersea earthquake 160 miles south of Banda Aceh and the huge tsunami it triggered on Sunday. Around 80,000 people are now recorded as perishing in Aceh province. The number of dead victims in Aceh and North Sumatra are expected to reach 100,000. Between one and three million of those affected by the tsunami in Aceh and North Sumatra are homeless.

Basically all the villages on the coastal line are completely gone.In some coastal towns there is nothing, as even the foundations of the houses have disappeared. Entire swaths of coastline are reduced to sprawling rubbish dumps.

Reuters, Satellite images show Aceh on northern Sumatra, Indonesia before and after the tsunami hit on Sunday.

More satellite images of Banda Aceh before and after the tsunami can be found at junk for code and many more over at Digital Globe.

The coastal town of Meulaboh in Sumatra has been destroyed whilst Banda Aceh, the provincal capital, is a wrecked city.

As the Jarkata Post says:

"The entire southern part of Indonesia, starting from Sumatra, Java, Bali, Nusa Tenggara to Maluku and Papua and also the northeastern part of the country -- Sulawesi and North Maluku -- constitute active seismo-tectonic regions. Potential volcanic dangers exist at places along these lines.....movements on the bed of the Indian Ocean can cause tension on either side of the fault line. If the accumulation of tension and energy at the sides of the tectonic lithospheric plates or the subduction zone becomes unbearable, more fresh earthquakes may occur."

Sunday's quake in Sumatra has increased the chances for more major earthquakes there.

Aceh has become a focus point. People will judge whether the new government of Susilo Bambang Yudhoyono, can really deliver by what happens in Aceh. At the moment the Indonesian government is being rightly criticized. Four days after the tsunami struck, only 60 volunteers from the government had been deployed, bodies are still strewn all over the city and there was an acute food shortage.

From what I can make out relief supplies sent from national and foreign organizations and governments are reaching the Banda Aceh airport. In fact, supplies are piling up there. But they are not being distributed quickly to the intended targets.

According to Doctors without Borders the population of Aceh has received no international humanitarian aid at all since the disaster struck four days ago. They are the first international organization to begin working in the area.

Why the delays and disorganization in Aceh?

The politics explains some of the inaction. Aceh is a region long caught up in armed rebellion against Jakarta's oppressive authority that is justified by a strident nationalism that has been unwilling to recognize regional differences in the nation state.

This political conflict has meant that the Indonesian government initially kept the international community at bay as it debated whether to open Aceh up to foreigners. The province had been almost entirely closed to any international presence due to military operations there.

Consequently, the Indonesian government's response has been slow and uncoordinated. This is the reaction of the Indonesian press to the disaster in Aceh.

Update

Breaking news can be found at the The SEA-EAT blog,the Wilkinews and Tsunami-info.org

Video streams can be viewed at Cheese and Crackers.

For accounts of what is happening in India see Kiruba Shankar, who is blogging from Chennai in India at KirubaShankar. For Malaysia see KTemoc at Bolehtalk and Jeff Ooio over at Screenshots.

December 31, 2004

tsunami#3: priorities

The death toll from tsunami caused by the earthquake on Sunday continues to mount. In the devastated Aceh region of northwestern Indonesia access restrictions to the conflict zone, bureaucratic incompetence and disorganization, and a simple lack of infrastructure, transport, and resources in a poor nation continues to block the lifesaving food, water and medicine reaching many of those in need.

This needs to be said:

Moir

What is worse is that though lots of big, generous promises are made, many of them are not kept. John Quiggin has more on this side of things.

What is sad is the way the right cannot resist playing politics with this tragedy. Have a look at Gerard Baker's construction of a narrative about the Americans being blamed for the devastation caused by the Sumatran earthquake.I kid you not.

I guess the reasoning is this. You have to blame someone don't you, and, as God is dead, so it's either a cruel nature or the Americans. This then provides an excuse to have a go at the left's rabid anti-Americanism. And away Barker goes. This stuff is published in The Times and is then recycled in The Australian.

Just to show that I'm not making this up consider Gerard Baker's anti-Americanism "argument" in this paragraph:

"In the past three days I have been impressed by the originality of the latest critiques of the evil Americans. The earthquake and tsunami apparently had something to do with global warming, environmentalists say, caused of course by greedy American motorists. Then there was the rumour that the US military base at Diego Garcia was forewarned of the impending disaster and presumably because of some CIA-approved plot to undermine Islamic movements in Indonesia and Thailand did nothing about it.

To be fair, even the most animated America-hater, though, baulks at the idea of blaming George W. Bush for the destruction and death in southern Asia. But the US is blamed for not responding generously enough to help the victims of the catastrophe. A UN official this week derided Washington's contribution as stingy.

It is a label that fits the general image abroad of greedy, self-absorbed Americans. They neither know nor care much about the woes of the rest of the world, do they?....I have been sneeringly asked once or twice this week by contemptuous British friends."

Baker goes from the paranoid left, to some British friends, to the UN! Very elastic "reasoning" that. The rest of the article is then taken up with the tight "refutation" of the "argument".It ends with based on a celebration of technology that allows us to control and master nature.

QED. And the old cliches are reinforced to boot.

Amazing. Simply amazing. I read it three times. I'm still shaking my head at the elasticity parading as witty rhetoric. The tectonic plates on the seabed off Sumatra slipped and collided. Nature has real powers. It is not a construct.

It is not just the lack of reasoning that is amazing. What is astounding is that Baker misses the realpolitik politics of America's image in the region by a country mile; and he fails to engage with the substantive argument against the US. The US offer of $35 million--up from the initial $15 million---is a miserly drop in the bucket. It is less than less than half what the Republicans will spend celebrating the Bush presidential inauguration later this month.

Some would say, aw heck, it's the silly season, after all. Give the poor old righties like Gerard Baker a break. And we know the neo-con's next line about the money--it's all about the US needing a strong military to defend freedom from the evil Islamofascist terrorists who hate us for what we are.

I cannot resist a bit of fun. My guess is that The Times is still suffering from from the cheap Xmas drinks put on by its proprietor at the office party.A low budget, cost saving Xmas cheer is what you'd expect isn't it. After all, the proprietor is an American. And Baker lives in Washington does he not? Does not George Bush lives on a ranch in Texas? I meet a journalist once who told that .....The Times has gone downhill because it has been too Americanized etc etc.

See how you can do anything you want with Baker's kind of elasticity.

We should forget the nonsense in the op-ed pages in The Australian and turn to Geoffrey MG's Beyond Wallacia, which is much more informative about what is a happening on the ground in northwestern Indonesia.

Wikipedia has a very good entry on the Indian Ocean earthquake and tsunami.

Update

Wizbang takes a different political tack to Gerard Baker.The right care more about the tsunami and its devastation than the left because the latter have posted less than the right on this issue.

"Still I have to wonder... We are continually told how much more liberals care more about their fellow man than conservatives, yet 60,000 people are presumed dead and many of the liberals hardly mention it...The numbers don't seem to tell the same story."

Best to let that one about liberals lacking compassion go whizzing bye. It is an American game.

December 30, 2004

Tsunami disaster #2

Survivors search a photo board of the dead as they hunt for lost family and friends in Velankani beach on the outskirts of Nagapattinam, 350 km south of the southern Indian city of Madras.

Reuters

Numerous aftershocks of magnitude 5.0 or greater have rocked the southeast Asia region since Sunday, with the most recent one, with a magnitude 5.7 struck 75 km (47 miles) west-southwest of Banda Aceh, Indonesia. These are too weak to cause additional tsunamis.

The Washington Post's map of the Indian Ocean region ravaged by the massive undersea earthquake and subsequent tsunami caused by movement amongst the tectonic plates in the Sumatra-Andaman Islands region. An impact map. The devastation in Sumatra recalls Krakatoa.

The death toll from the tsunamis and the earthquake itself may be matched by people in the devastated communities dying from communicable diseases (eg., cholera, typhoid) as from the tsunamis.

Things are not looking good in Aceh province in Indonesia. Relief is in short supply as the aid arriving at the airfield is not being distributed by the Indonesian military and government authorities. Apparently there is a policy policy of keeping all but members of the military out of the strife-torn province. The relief effort and the recovery of bodies, is only clicking into gear three days after the catastrophe struck. So survivors in Aceh face starvation.

A big failure lies with the lack of an equivalent to the Pacific Tsunami Warning Center, which is responsible for tsunami monitoring in the Pacific Basin. No such warning system exists for the Bay of Bengal where the recent disaster occurred. Can the finger be pointed at the Australian Government for this? Should it?

Update

A comment from IRant

Can the finger can be pointed at the Australian government for the lack of a warning system for Thailand, Indonesia, India etc?

"I think it is poor form to implicate the Australian government for lack of a warning system. The impetus and political will for a warning system has to come from the governments within the affected area. Indeed, such a system was proposed but due to the costs and the fact tsunamis are relatively rare occurence in the area compared to the Pacific such an idea was abandoned.

This article has some more info.I have no problem with pointing fingers when it is justified, but in this instance it is totally unwarranted."

Gary's Response

IRant Maybe. Australia could help to kick things long though.We are geographically part of the Indian Ocean,and we have more scientific resources to do this than Indonesia or Bangladesh.We should be good neighbours on issues like this. We are to turned to the Pacific.

Another, more selfish consideration.

At 1.59am on Xmas eve there was an earthquake measuring 8.1 in the sea north of Macquarie Island. It was one of the bigger earthquakes in the past 100 years and it could have triggered a tsunami, if the tectonic plates had collided rather than slipped past each other. If they had collided we could have kissed Kangaroo Island and the coastal towns along South Australia's southern coast line goodbye. The tsunami would have flooded the western suburbs of Adelaide.

And there would have been no warning.So Australia is cavalier and negligent. The example shows that tsunami's could hit this continent from any direction. Australia needs a tsunami warning system.

That warning system could be linked into one for south east Asia/ the Indian Ocean.

Update

Shaun ((IRant) replies to my response:

"Re you reponse I think Australia has and will be urging the creation of a warning system. Geoscience Australia did issue a report in September last year stating a system should be put in place for the Indian Ocean.

As for your comments re the Macqaurie Island quake, I've emailed

Geoscience Australia as it is a good question. Let you know if I get

a reply. I also found the following discussion from the 7:30 Report on the ABC."

Gary adds that Geoscience Australia is aware of the issues. So is it the federal pollies dragging their heels on this kind of security?

comment spam

Due to heavy spamming over Xmas the file mt-comments.cgi has been disabled. So the comments function is turned off. No comments can be made. The trackback function does not work.

These spammers sure are bottom feeders. Their destructive actions indicate the way that capitalism destroys the public commons and why the free market needs regulating and policing.

I am currently in the process of a long overdue upgrade to Movable Type v3.14 plus MT-blacklist as a first step to deal with the pernicious comment spam problem. It would appear that there has been a targeting of MT, due to the popularity of its publishing system, by the spammers.

In the meantime I have been using the old ISP banning method.However, as the spammers had so many domains in their arsenal, trying to add each of them as a Blacklist string was futile. It was fighting a losing battle. I was spending hours over Xmas deleting their comments on a slow dialup.

The reason I stayed put with this for so long was that I've been waiting for Movable Type to fix the bugs in their MT-blacklist software that resulted in escalating comment spam that caused extreme server loads. Movable Type has been working on the problem.

I'm not sure whether the spam comment problem has been solved. People are voting with their feet and moving on: --onto WordPress. I've decided to pay my monies to the now corporatised Moveable Type and to stick with them. Things are changing in the blogging world.

In the meantime--until the upgrade and plugins have gone through--comments can be emailed to me and I will incorporate them into the post as an update, to which I may respond.

Update

The Movable Type upgrade has been successful.However, problems are currently being experienced with the Movable Type comment spam Blacklist plugin. It will be addressed tomorrow with the help of some local tech support.

December 29, 2004

Wal-Mart

The discount retailer Wal-Mart is Fortune's most admired corporation. It has taken advantage of the rise of information technology and utilized the explosion of the global economy to outsource its supplies and gained control of the supply chain.

Wal-Mart's low-wage model, technologically efficiency and global reach has changed the balance of power in the business world. It has become the template of American capitalism in the 21st century. It has become one of the most profitable companies in the world and the darling of Wall Street.

Does Wal-Mart represent the future of retailing in Australia? One in which the mass global retailer is the center of economic power?

When Wal-Mart moves into a community, other, smaller retailers get pushed out, because Wal-Mart can undercut their prices 20, 30 percent. Wal-Mart can stay there. Other retailers leave. On the supply side Wal-Mart squeezes its suppliers. They cannot pass higher costs on to Wal-Mart, because Wal-Mart is so big. The suppliers can't make profits and they are finding that they can't meet Wal-Mart prices. So Wal-Mart goes offshore to China and the suppliers go out of business if they aren't able to go offshore to set up low cost production.

Wal-Mart is a world of low wages and poor benefits, sex discrimination against women, tough conformity, a rigid hierarchy and authoritarianism.

It is a new world of the working poor spent scraping by on the poverty line, anti-union company, corporate welfare and exploitation of the working poor as central to its business strategy. This is a workforce which rapidly turns over because the technology means that you can just slot one person into the job with no training and no sort of background.

Is this new American model for employment the future of Australian capitalism, rather than an innovation model based on higher wages, new products and good benefits for Australian workers?

a historical eye

A quote from the New York Review of Books. It concludes an article entitled 'On War' by Chris Hedges.

"We are losing the war in Iraq. There has been a steady increase in the assaults carried out by the insurgents against coalition forces. The attacks over the past year have risen from about twenty a day to approximately 120. We are an isolated and reviled nation. We are tyrants to others weaker than ourselves. We have lost sight of our democratic ideals. Thucydides wrote of Athens' expanding empire and how this empire led it to become a tyrant abroad and then a tyrant at home. The tyranny Athens imposed on others it finally imposed on itself. If we do not confront our hubris and the lies told to justify the killing and mask the destruction carried out in our name in Iraq, if we do not grasp the moral corrosiveness of empire and occupation, if we continue to allow force and violence to be our primary form of communication, we will not so much defeat dictators like Saddam Hussein as become them. "

It captures the way the US republic is being overtaken by empire.

December 28, 2004

Tsunami disaster

I've been out of action and decoupled from the news for the last couple of days because of the Xmas thing. I've only just caught the news about the natural disaster in south East Asia.

A magnitude 9 earthquake, caused by a slippage in the earth's plates, struck off the west coast of the Indonesian island of Sumatra early Sunday. It then unleashed waves (tsunami's) up to 10 metres high that roared across the Bay of Bengal at 800kph, ripping into Thailand in an hour and striking Sri Lanka and India within two and a half hours. The waves raced 4,500 km to Africa, killing hundreds of people in Somalia and three in the Seychelles.

The tsunami crashes through houses at Maddampegama, Sri Lanka, AP

Marina beach in Madras, AFP

Thousands of kilometres of coastline from Indonesia to Somalia were battered by Sunday's deadly waves. Australia escaped.

Current estimates are that the carnage from both the Indian Ocean earthquake and tsunami will be more than 24,000 dead. The Indonesian Government is estimating that up to 25,000 people on Sumatra island alone have been killed, with most of the deaths in Indonesia in the Aceh province, on the northern tip of Sumatra Island. In Sri Lanka the toll is above 18,000; 10,000 in India and 2000 in Thailand.

Uncovered bloated and bruised bodies are everwhere in the midday sun. A lot of fishing villages have been wiped out, along with the means for earning a livelihood. It is a human tragedy.

In philosophy I01 these natural disasters are called "acts of God" rather than the awful power of Mother Nature. What the university lecturers were trying to get at is that there is no moral responsibility for this kind of evil (human tragedy), as it is not caused by human beings.Though it may create problesm for those who believe in an interventionist God.The moral finger can be pointed at the failure to establish a tsunami warning system in the Indian Ocean.

Update: 30 Dec.

One eyewitness account of the tsunami that has left millions homeless in countries from south-east Asia to Africa.

Mass graves are being dug. Bodies burned.

AP, Volunteers cremate bodies recovered from the debris in Nagapattinam, India

Many bodies are so bloated and fly-blown that it is impossible to tell even their sex. The stench of decomposing bodies fills the air as hungry people scavenge to find food and fresh water.

The danger is that waterborne diseases, such as cholera, could kill a lot more people due to contaminated water and food. Cholera is endemic in Sri Lanka and southern India, two of the countries worst hit by the tsunami. The bacterium is likely to be present in mangrove swamps. Outbreaks often follow flooding, when the bacterium can contaminate supplies of drinking water.

The death toll keeps climbing rapidly.The final death toll in the Indonesian province of Aceh, which bore the brunt of the Indian Ocean tsunami, could be as high as 80,000. The death toll could exceed 100,000.

This is shaping to be a major natural disaster and a human catastrophe.

December 27, 2004

Gunns v Greens#3

An article in The Age by Steven Curry that responds to Greg Barnes defence of Gunns. Curry in support of my position, that the Gunns suit is a SLAPP designed to damage as many prominent foes as possible and to hurt the protest movement. It is a use of the civil courts to undermine basic democratic values.

In commenting on my criticism of Barnes Rick took issue with my argument about needing to shift from the logging of old growth forests to plantations to ensure a sustainable forestry. These comments are too important to be left in the comments section of that earlier post. I am posting it in full.

Rick says:

"In very approximate proportions, the nation’s wood comes about one third each from plantations, native forests and imports. The main point here is that as native forests close down as sources, the proportion of imports increases. This shift is taking place now, and if the plantations had the capacity to pick up where the native forests leave off, I wouldn’t be arguing with you now.

In terms of sawn wood, the plantations that are ready for harvest now were planted in the 60’s, 70’s and 80’s. There is some wood coming from younger plantations, but this would be from highly productive sites, and thinnings, much of the latter being undersize, marketed as posts or chipped for particleboard and paper.

There is a belief around that we have enough plantation resource to supply everything we need, and there is even a resource economist, whose name escapes me, who has written a paper to this effect. Apparently there is a conspiracy to withhold plantation resources so that we can knock over more native forest. She is, in the opinion of the industry, wrong. I haven’t read the paper, but the fundamental gap in her argument to me is that plantations are expensive to establish, and the longer the interval between establishment and harvest, the worse the economics look. Private and government organisations that established plantations that are approaching final harvest now have been paying interest on those investments for decades. If you do the analysis of the present value of a future sum of money, you’ll see that the long period between establishment and financial return makes sawlog plantations a risky investment. The ever-accumulating interest (govt departments pay interest too) is the main burden. So in this situation, to argue that any plantation owner would deliberately delay harvest for long periods of time is to argue that money is free. Another particularly important point is that plantations reach a harvestable size and then wood production slows down without further thinning. Modern pine mills are also not built to saw large logs, so the cost of milling “over mature” logs begins to rise. There are many details glossed over here, such as early revenue from thinnings and silvicultural strategies, but this will be too long as it is. Basically, a plantation management timetable is determined by silviculture (agronomy for trees) and economics. Conspiracy theories about this are like most conspiracy theories; a shred of evidence and a lot of imagination.

It is normal to say “they” should have planted more plantations in the 70’s and 80’s. Back in those days, social attitudes were different, support for plantations was much less and hindsight has always been excellent.

More plantations should be established now, I don’t think there is any disagreement between us on that. A few points:

1. New sawlog plantations will not come onto the market for many years, and we need to be discussing where our wood should come from in the interim decades. The current situation looks to me like we will import much/most of it from the rainforests of Asia because that’s the cheapest source.

2. Long rotation sawlog plantations don’t look very attractive compared to a pulpwood plantation harvested once at age 10. At present most of the private investment goes to pulpwood. Why? 10 years fits within a working life. Not many people early in their working life have the wealth to invest in longer rotation plantations. Consequently most of the sawlog investment comes from corporations, of which Gunns is one of the most prominent.

3. From the industry side, things look bleak. Our opponents may say “they have brought it on themselves”. But they must realise that an industry with an uncertain future doesn’t attract finance readily for 20-40 year investments. As evidence, Wesfarmers, who bought Bunnings and have sold the timber production side of the business as quickly as possible. Meantime, the timber and hardware sales side of Bunnings is an economic flagship. We are collectively busy buying wood, but we don’t understand what it takes to make it.

4. I have mentioned previously that there have been concerns expressed by Brown that too much prime farmland is being swallowed up by bluegums. The most vitriolic criticism of forestry is directed at woodchipping. The modern bluegum plantations are a deliberate strategy, initiated in the late 80’s with levies on native forest woodchip exports in WA, to establish a plantation resource to supplement, and then perhaps even replace, the native forest resource. This is an example of industry financing, under government pressure, the development of a plantation wood resource for a particular market. The result is further criticism and the principal proponent of this strategy has been vilified as the worst thing to happen to WA forestry by the greens and he has been reskilled. The worst fallout from this is the implication that forestry will be attacked no matter what it does. Not a healthy social environment for long-term investment.

5. We already have plantations, even pine, that are impossible or difficult to log because of public concern about the aesthetic impact. This is not public belligerence, but it demonstrates the somewhat irrational nature of the human animal. We all like a sense of continuity and dramatic changes to the landscape cause concern. Hence there is usually strong opposition to the establishment of plantations if they are large scale and impact on the visual character of a district. The next generation of people grow up used to the plantations and then oppose the harvesting phase. Normal behaviour; I’ve heard anecdotes along these lines from around the world.

6. The plantation industry is commonly criticised for using monocultures. This is a basic economic requirement for the production of wood and with the high cost of establishment of plantations on one side and the cheap resource in neighbouring Asian forests on the other, monocultures are here to stay. If you look at European forests, they are very largely monocultures and people there are very attached to their plantation forests as a place of recreation. (They also don’t seem to have much trouble, to my knowledge in Sweden, Finland, France, Germany and Austria, with harvesting those forests in the full view of the public.) I have noticed anecdotally that there is mounting opposition from green people to the bluegum plantations in WA due to this monoculture concern.

7. There is discussion about, and some trials, growing mixed species of native trees in plantations. These will be more expensive to manage, but we could pay more for our wood, especially when the Asian forests run out in the future. But if there are instances of people becoming attached to their neighbourhood pine plantations, there is a strong possibility that today’s mixed native species plantation will be tomorrow’s high conservation value forest. This happens virtually every time a regrowth native forest (argued by most people to be appropriate for timber harvesting) approaches final harvest. This point also demonstrates the irrationality of, or at least circular logic of, the belief that harvesting forests “destroys” the forest.

In general, you are arguing sensibly that there should be a move from native to plantation forests, and most people do the same. As individuals. But if you take the general form of public opinion, which is what influences political behaviour and policy, the situation is different. Public opinion sloshes around under the influence of many factors, but it is comparatively easy for a dissenting minority to stir up support AGAINST many issues. It is very difficult to harness such unified public support FOR a complex reasoned argument. When it comes to intergenerational resource production and management, we don’t seem to be coping very well.

The RFAs were an attempt to develop a negotiated long-term strategy, with all parties at the table. I am not aware of the details nationally, but my understanding is that the major green groups refused to participate in this process because by standing aside from the negotiating table, they were free to then attack the Agreements as soon as they emerged. It must have been difficult for the greens to sit at the table with the industry if government and industry have responsibility for supplying the nation with the wood it consumes. There will always be a gulf between those with ideals and those with responsibilities. Politically, this has been a most successful green strategy and it even calls into question, are they about responsible resource management, a genuine practical balance between our consumption of resources on one hand and the protection the environment on the other, or are they just out for political influence? When your genuinely held fundamental aim is to “save the world” (who can oppose such an ideal?), almost any means could be justified by the end.

In terms of responsible long-term resource management, the RFA process seems have been a disaster. Decisions were made without the benefit of a stronger conservation influence. The situation is now more chaotic than it was before. Why are we surprised that there is inadequate plantation resource being established?

I consider it reasonable to conclude that the core of the green movement is indirectly working for the removal of commercial forestry from this country. They don’t have that as a formal part of their platform, probably very few if any of them recognise what impact they are having. But the net real effect of their efforts is that commercial forestry in this country is too expensive and subject to too many wild swings in the public mood (measured over the length of a forest rotation). The industry here will diminish further and responsibility for our wood resource will move off shore, because there is a lot of cheap old growth forest over there, at the moment."