|

June 6, 2013

In his Ending the Great Australian Complacency in the early 21st Century speech Ross Garnaut addresses the fateful choice that Australians will need to make in the months and years ahead about how to respond to hard times after more than two decades of extraordinary prosperity. It's not the choice at the forthcoming federal election.

The hard times choice is at a time of international financial uncertainty that is still dragged down by the overhang from the global financial crisis and where the causes of the crisis mostly remaining at large. It comes at a time of ideological uncertainty, with doubts growing about whether the political and economic systems of the developed world of which Australia is part still have the capacity to deliver prosperity to most of their citizens.

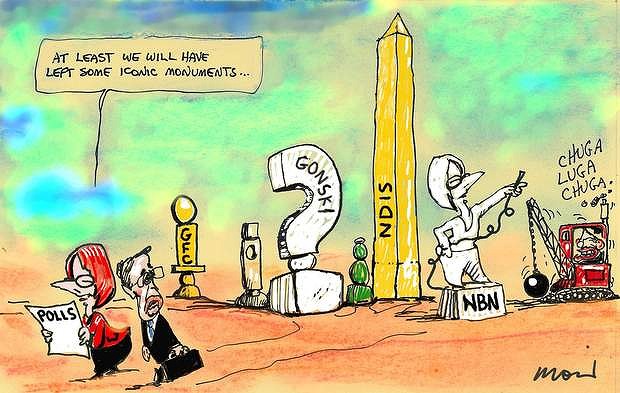

Alan Moir

Alan Moir

Garnaut, now at the University of Melbourne, says that we face three big challenges if we're to avoid the end of the long boom leaving us with much to regret:

(1) The first is that our real exchange rate now needs to fall a long way to be consistent with full employment.

(2) The second challenge, he says, is to change entrenched expectations that living standards will rise inexorably over time; that household and business incomes and public services will rise and taxes will fall, as they have done for a generation.

(3) The third challenge we face is that our political culture has to changed. It has changed since the reform era 1983-2000, in ways that make it much more difficult to pursue policy reform in the broad public interest. If we are to succeed, the political culture has to change again.

Basically Australia’s external position is weak with the approaching end of the China resources boom and this will result in the fall of the foreign exchange value of the Australian dollar and it will result in reduced living standards—the amount of goods and services that Australian incomes and expenditure support—unless there are corresponding increases in the productivity with which Australian resources are used.

The key depends on how successful we are in restoring growth in our trade-exposed industries outside the resources sector and a strong revival of investment and exports in services, manufacturing and agriculture as well as some moderation of the decline in resources investment.

He says that the economic choice is that after the decades of prosperity, Australians now must choose between two radically different approaches to our problems.

Do we accept persistent large increases in unemployment and large declines in living standards under Business as Usual--[ie.,conduct our public life as if the approaches that were good enough in the days of easy prosperity can deliver acceptable outcomes in harder times].? Or do we accept a Public Interest approach: think hard about how to achieve a large reduction in the real exchange rate and how to lift productivity and to share across the Australian community a moderate reduction in living standards? The moderate reduction in living standards will be smaller and of shorter duration the more it is accompanied by restoration of strong productivity growth.

Garnaut is pessimistic given that the political culture is now one in which policy change in the public interest has become more difficult over time as interest groups have become increasingly active and sophisticated in bringing financial weight to account in influencing policy decisions.

A new ethos has developed in which there can be no losers from reform. Business has asserted a property right to continuing benefits of regulatory mistakes. It demands compensation for corrections to errors in policy. Households have been led to expect that no policy changes will cause any of them to be worse off.

The limits of intrusion of private interests of many kinds into setting the rules for a market economy have been eased. An example is the Business Council dream of ''reforms'' that advance their private interests (industry welfare,) at the expense of the rest of us.

|

The economy is undergoing a difficult transition as the investment phase of the mining boom begins to fade. The media, working in terms of black and white, are saying that Australia is heading for a recession. There has been near hysteria amongst many business commentators and economists.